Home Equity Loans & HELOCs - With $0 Application or Closing Fees**

Put your home's equity to work. LincOne pays ALL closing costs on Fixed Home Equity Loans and HELOCs, so you keep more of your money from day one. You will find our rates competitive and our repayment terms flexible. Loans are available for up to 100% of the appraised value of your home, with a wide range of terms available. Use a home equity loan to consolidate debt, remodel your home, travel, purchase a vehicle, or finance your child(ren)'s continued education. (Consult your tax advisor for possible tax deduction.)

$0 Application Fee**

$0 Closing Costs**

$0 Origination Fee**

$0 Annual Fee

Home Equity Loans

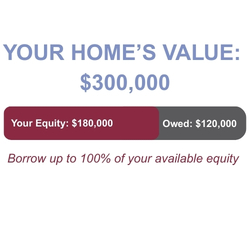

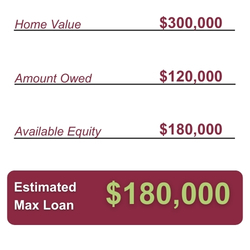

Home equity is the difference between your home's value and the amount you still owe on your mortgage. As you pay down your loan and your home's value grows, that equity becomes a powerful financial tool. Currently at LincOne, you can access your home's equity with no additional fees.

Fixed Home Equity Loan

Best for one-time, planned expenses. Provides you with a predetermined amount of money up front for a specific period of time, usually with a fixed interest rate.as low as 5.75 APR *

| Features |

|---|

| $0 Application Fee |

| $0 Closing Costs, LincOne pays all |

| Fixed rate for the life of the loan |

| Borrow up to 100% of your equity |

| Terms: 60 or 120 months |

| Predictable monthly payments |

Home Equity Line of Credit

Best for ongoing flexible expenses. A fixed amount of credit with a variable interest rate that you can draw from as you need it.as low as 6.75 APR *

| Features |

|---|

| $0 Application Fee |

| $0 Closing Costs, LincOne pays all |

| Draw funds as you need them within a 5 year period |

| Borrow up to 90% of your equity |

| Variable rate based on Prime Rate |

| No annual fee |

No Early Termination Fees

No Prepayment Penalties

No Annual Fees

What Can You Use It For?

Home equity is one of the most flexible financial tools available to homeowners.

Home Renovation & Repairs

Home Renovation & Repairs

Debt Consolidation

Debt Consolidation

Education Costs

Education Costs

Emergency Expenses

Emergency Expenses

Life Events

Life Events

Large Purchases

Large Purchases

Fixed Home Equity vs. HELOC - Which is Right For You?

| Feature | Fixed Home Equity Loan | Home Equity Line of Credit |

|---|---|---|

| Best For | One-time lump sum needs | Ongoing or flexible expenses |

| Rate Type | Fixed | Variable (based on Prime Rate) |

| Closing Costs | $0, LincOne Pays all closing costs | $0, LincOne Pays all closing costs |

| Application Fee | None | None |

| Borrow Up To | 100% of equity | 90% of equity |

| Access to Funds | Lump sum upfront | Draw as needed |

| Terms Available | 60 or 120 months | Variable draw period |

How Much Can You Borrow?

Use our home equity calculator to estimate your loan amount based on your home's current value and what you still owe.

Fixed Home Equity Loan & Home Equity Line of Credit Rates

| Terms up to | Loan to Value | Fixed Rate |

|---|---|---|

| 60 Month | 80% | As low as 5.75%* APR |

| *All Closed End Loan rates include .50% off for automatic payments made from LincOne Checking Acct $5,000 in new money required to receive advertised 5.75% APR rate. Loans subject to credit approval. Annual Percentage Rate is accurate as of effective date listed. Real estate closing costs/fees vary based on loan amount, location and type of loan. Taxes and insurance premiums not included in payment. All loans subject to approval & rates subject to change without notice. | ||

| 120 Month | 80% | As low as 6.75%* APR |

| 60 Month | 90% | As low as 6.75%* APR |

| 120 Month | 90% | As low as 7.75%* APR |

| 60 Month | 100% | As low as 7.25% APR |

| 120 Month | 100% | As low as 8.25% APR |

| Loan to Value | Variable Rate* | Based off Prime Rate |

|---|---|---|

| 80% | 6.75% APR | (Prime Rate) |

| 90% | 7.75% APR | (Prime + 1.00%) |

*VARIABLE RATE INFORMATION: The Annual Percentage Rate (APR) is accurate as of effective date listed and may vary quarterly. The APR is based on the Wall Street Journal Prime Rate. The maximum APR that may apply is 18%. Closing costs may vary between $200-$600. Other restrictions may apply. All loans subject to approval. Please call LINCONE for payment information and examples: 402.441.3555 | ||

*All Closed End Loan Rates include .50% off for automatic payments made from LincOne Checking Account. All rates advertised require an autopay from a LincOne Checking Account. With approved credit. $25 Savings account balance is required. Rates, terms, and conditions are subject to change without notice. LincOne will pay for ALL closing costs on fixed-rate and HELOC loan applications. The member is responsible for escrow payments and/or prepaid costs, if required, including property taxes and assessments, homeowners’ and flood insurance premiums, association fees/dues and assessments, and prepaid interest.

**No application fees or closing fees on new loans now through 5/31/2026, new money only.

Home Equity FAQs - Frequently Asked Questions

A fixed home equity loan is a loan where a homeowner borrows against the equity in their home and receives a lump sum with a fixed interest rate and set repayment schedule. The benefits include predictable monthly payments, protection from rising interest rates, and a consistent plan for paying off the debt. This type of loan is ideal for large, one-time expenses such as home renovations, debt consolidation, or major purchases, and is best suited for borrowers who prefer financial stability and can manage regular payments over the loan term.

A Home Equity Line of Credit (HELOC) is a revolving credit line that allows homeowners to borrow against the equity in their home, providing access to funds as needed up to a pre-approved limit, with a variable interest rate. The benefits include flexibility in borrowing and repayment, interest-only payment options during the draw period, and potentially lower initial interest rates. This type of loan is ideal for ongoing or unpredictable expenses such as home improvements, education costs, or emergency funds, and is best suited for borrowers who need access to funds over time and can handle variable interest rates and payment schedules.

A Home Equity Loan gives you a one-time lump sum that you repay in fixed monthly installments over a set term. It's a great fit when you have a specific expense in mind, like a major renovation or debt consolidation, and want predictable payments from day one.

A HELOC (Home Equity Line of Credit) let's you draw funds as you need them within a five year draw period. You're approved for a maximum credit limit and can borrow, repay, and re-borrow during a set draw period. This flexibility makes a HELOC ideal for ongoing projects or expenses with unpredictable timing.

Most home equity loans and HELOCs close within 2 to 4 weeks from the time of application. The exact timeline depends on factors such as property appraisal scheduling, document verification, and title review. The LincOne lending team moves quickly to keep things on track so you can access your funds as soon as possible.

Closing costs typically cover fees for items such as property appraisal, title search, title insurance, and recording. The exact amount varies based on your loan size and location. Before you finalize anything, we'll provide you with a clear, itemized Loan Estimate so you have full visibility into every cost, no surprises at the closing table.

From March 1st, 2026 - May 31st, 2026 LincOne is covering all application and closing costs.

Draw Period — Years 1–5

Borrow from your line of credit as needed, up to your approved limit. During this phase you'll make interest-only or minimum payments on the outstanding balance. You have full flexibility to draw and repay multiple times.

Repayment Period — Years 6–17

Once the draw period closes, you enter a 12-year repayment phase. No additional draws are available. You'll make regular monthly payments of both principal and interest until the balance is fully paid.

Once your 5-year draw period ends, the line of credit closes and you will no longer be able to draw additional funds from it. If you'd like access to a new line of credit after that point, you would need to re-apply for a new HELOC. Our Relationship Advisor is happy to walk you through the process and discuss your options when the time comes.

No. We do not charge early termination fees on our home equity loans or HELOCs. If your situation changes and you need to close the loan ahead of schedule, you can do so without any additional cost.

No. There are absolutely no prepayment penalties. You're free to pay down or pay off your loan balance at any time, and every extra dollar you put toward principal saves you money on interest, with no fees to worry about.

No. We do not charge annual fees on our HELOCs. You can maintain your line of credit throughout the 5-year draw period without worrying about any recurring annual charge eating into your available funds.

Go to main navigation