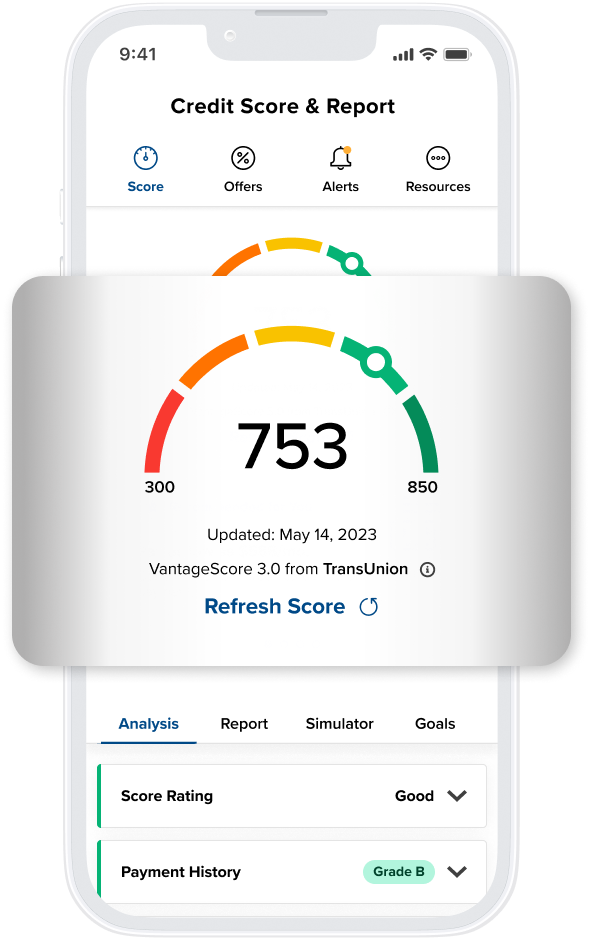

Monitor your credit score for free, anytime, anywhere.

What is SavvyMoney?

As part of our upgrade, we are excited to provide new products to you, our LincOne members! SavvyMoney is a free tool available in the Mobile App and Online Banking that provides daily access to your credit score, personalized credit tips, and credit monitoring, all without affecting your credit score. It helps you track credit changes and make smarter financial decisions, all in one place!

Start using SavvyMoney today!

Enroll in SavvyMoney via our mobile app or online banking today!

Key benefits & unique features:

- Daily credit score access without affecting the score

- Real-time credit monitoring alerts

- Personalized credit report and insights - Offer tailored advice based on your credit score, personalized to you and your credit report.

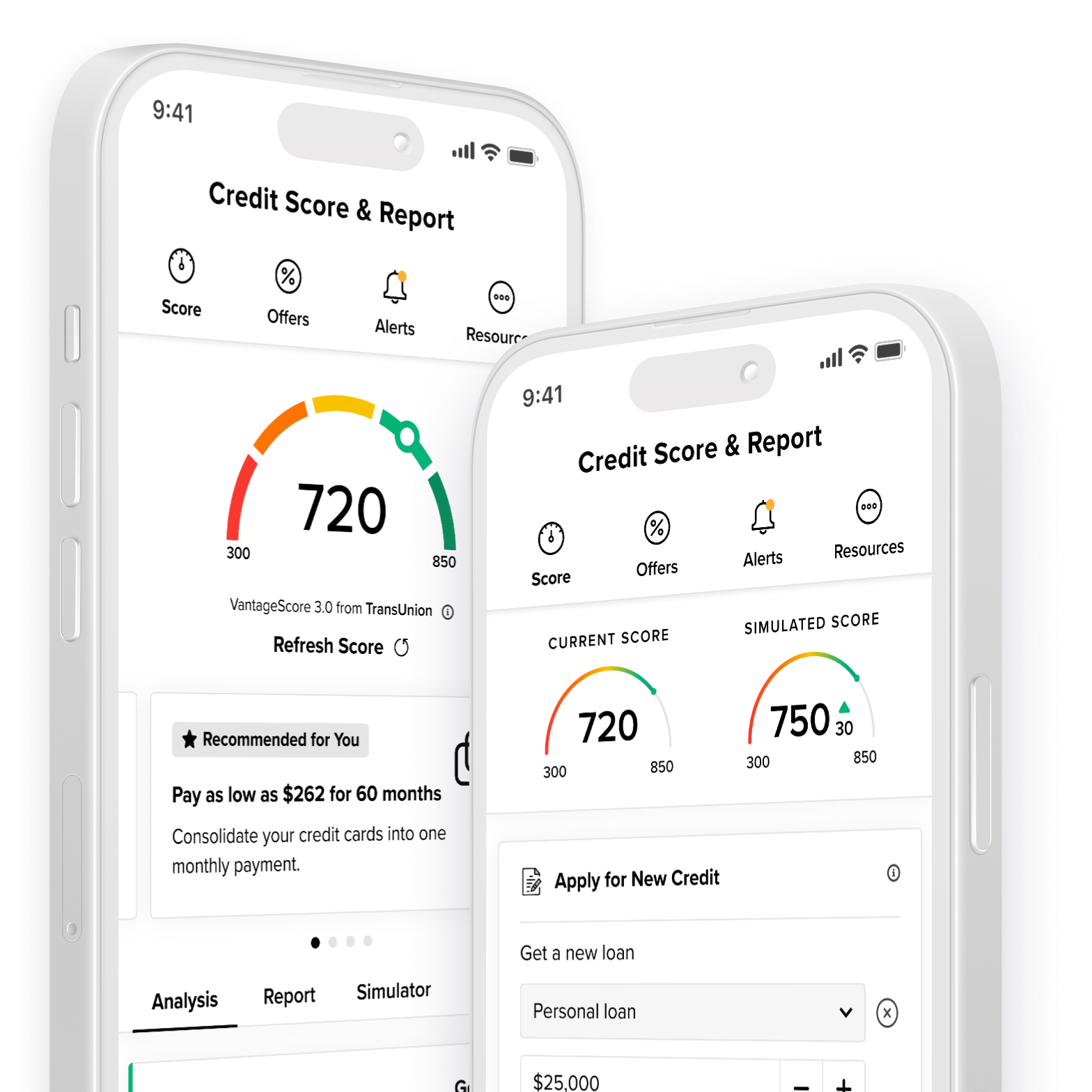

- Credit score simulator - Allows you to model financial decisions and see potential impacts on your credit score.

How to Enroll

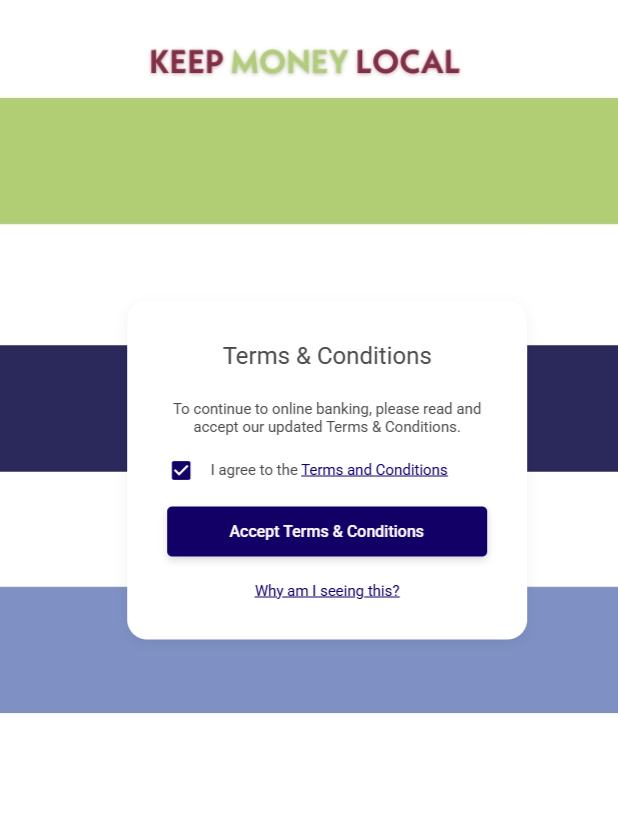

1) After logging in successfully, click "I agree to the Terms and Conditions."

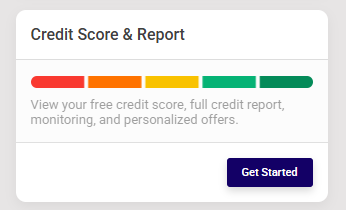

2) Click on the Credit Score & Report widget within Online Banking or the Mobile App. Click "Get Started" to see your credit score!

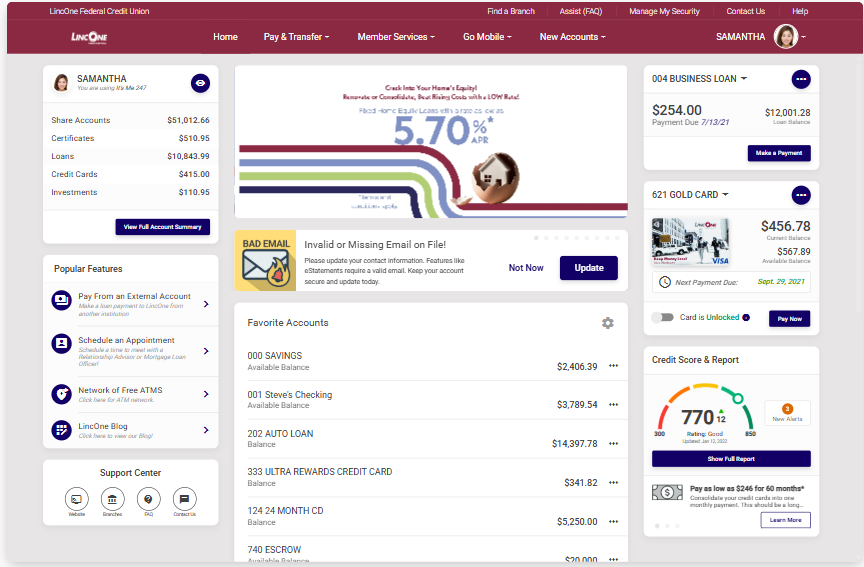

3) The SavvyMoney widget is located in the bottom right, under debit cards in your online banking.

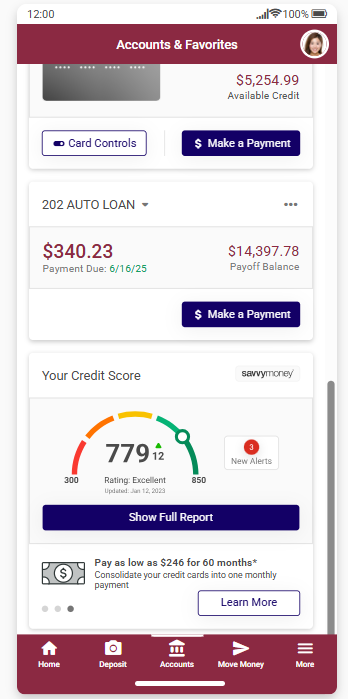

4) Within the mobile app, you will find SavvyMoney within the Accounts tab under the debit cards section.

Start using SavvyMoney today!

Enroll in SavvyMoney via our mobile app or online banking today!

SavvyMoney Frequently Asked Questions

No. Viewing your credit score through SavvyMoney is a soft inquiry and does not impact your credit score in any way.

Your score is updated daily, so you can stay informed and track changes regularly.

Yes. SavvyMoney is completely free for members and available through the mobile app and online banking.

Simply log in to your account via mobile app or online banking account, find the “SavvyMoney” section, and follow the prompts to enroll.

SavvyMoney uses data provided by TransUnion, one of the three major credit reporting agencies.

If you spot an error, you can dispute it directly through the credit bureau or through the SavvyMoney Widget by:

- Within the credit report section, scroll to the bottom.

- Within the "See any errors?" Click Start a Dispute and follow the prompts via TransUnion.

Yes. SavvyMoney offers personalized tips and a credit score simulator to help you understand how different financial decisions could impact your score.

Yes. SavvyMoney is fully integrated into the mobile app, so you can monitor your credit anytime, anywhere.

No, LincOne uses its own lending criteria for its loan products.

SavvyMoney helps you stay on top of your credit so you're prepared when it's time to finance major life purchases such as a home, car, or education. By being familiar with your credit health, you'll be in a better position to qualify for lower interest rates. Plus, you may receive personalized loan offers that could help you save on both new and existing loans.

The fine print: The services are provided by SavvyMoney, Inc. and do not represent any agreement by LincOne Federal Credit Union to provide any product, service, or other benefit to you. Information provided by SavvyMoney, Inc. is for educational purposes only and does not constitute accounting, tax, legal, real estate, mortgage, financial planning, or investment advice from LincOne Federal Credit Union. The credit report card and score shown in SavvyMoney are not used to determine loan rates or loan approval; loan decisions are based on information you provide separately to LincOne Federal Credit Union during your loan application. The credit score used by LincOne Federal Credit Union may differ from the score provided within SavvyMoney.

Go to main navigation